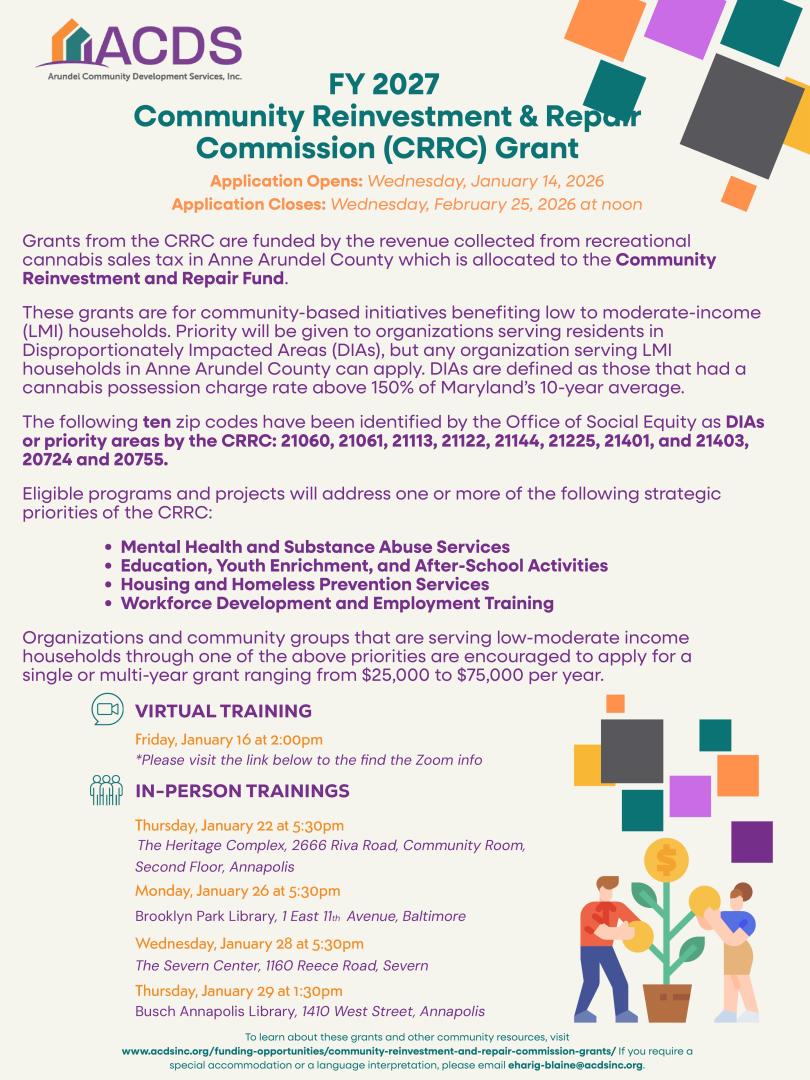

The application for the Local Fiscal Year 2027 CRRC Grant opened at 2pm on Wednesday, January 14, 2026

The application is available through the Neighborly Portal. Registration for a free Neighborly account will be required.

All applications are due at 12pm on Wednesday, February 25, 2026.

A recording of an application training held on Friday, January 16 can be found here and the presentation slides from the training can be found here.

A list FY26 CRRC grant awards can be found here.

What are the CRRC and CRRF?

The Anne Arundel County Community Reinvestment and Repair Commission (CRRC) was formed in response to the Cannabis Reform Act, which was passed by the Maryland legislature in 2022. This act legalized adult-use recreational cannabis and led to the establishment of the Community Reinvestment and Repair Fund (CRRF). A portion of the sales tax from adult-use recreational cannabis sales is allocated to the CRRF. The purpose of the CRRC is to make recommendations for the use of the funds in the Anne Arundel County CRRF.

The Anne Arundel County CRRC and CRRF were established through a County Ordinance 57-23, which can be found here. The CRRC will be supported by Arundel Community Development Services (ACDS) who will be responsible for administering the grant funds from the CRRF, as recommended by the CRRC.

CRRC Members

The Community Reinvestment and Repair Commission is comprised of up to 13 members residing in Anne Arundel County, with members being nominated by the following:

- 9 members from the County Executive

- 2 members from the County Council

- 1 member from the Mayor of Annapolis

- 1 member from the Annapolis City Council

A current list of members serving on the Community Reinvestment and Repair Commission can be found here.

Eligibility

The revenue collected from the recreational cannabis sales tax is allocated to the CRRF. Grants will be available for “community-based initiatives intended to benefit low-income communities.” Priority will be given to organizations serving residents in Disproportionately Impacted Areas (DIAs). Disproportionately Impacted Areas (DIAs) are defined as those that had a cannabis possession charge rate above 150% of Maryland’s 10-year average.

The Maryland Office of Social Equity has identified eight (8) zip codes in Anne Arundel County that have been designated as DIAs. A list of those zip codes can be found here and a map of those zip codes can be found here. The Office of Social Equity published a report on the community-identified priorities for this funding which can be found here. The following ten priority zip codes have been identified by the Anne Arundel County CRRC: 21060, 21061, 21113, 21122, 21144, 21225, 21401, 21403, 20724, 20755.

The following strategic priorities were identified by the Anne Arundel County CRRC. Eligible projects and activities will address one or more of the following priorities:

- Mental Health and Substance Abuse Services

- Education, Youth Enrichment, and After School Activities

- Housing and Homelessness Prevention Services

- Workforce Development and Employment Training

Meetings

The CRRC meets on the second Monday of each month from 5:30 to 7:30 p.m. in the Rosenwald Conference Room on the second floor of 2666 Riva Rd, Annapolis, and a virtual option is available here. The CRRC will not hold a meeting in February and future meeting details will be posted here. If you would like to provide a 2 minute comment or question during the public comment period of a meeting, please complete this form.

Agendas, Minutes, Presentation Materials, and Recordings of past meetings are available below.

December 8, 2025

November 10, 2025

October 13, 2025

September 8, 2025

July 14, 2025

- Agenda, Minutes, and Recording

- Presentations: Funding Allocation Recommendation

June 9, 2025

May 12, 2025

April 14, 2025

March 10, 2025

February 10, 2025

- Agenda, Minutes, and Recording

- Presentations: CRRF Fund Balance

January 13, 2025

- Agenda, Minutes, and Recording

- Presentations: Census Tract Maps

December 9, 2024

November 13, 2024

October 21, 2024

- Agenda, Minutes, and Recording

- Presentations: Office of Social Equity & ACDS

September 12, 2024

- Agenda, Minutes and Recording

- Presentations: County Executive’s Office & ACDS

How To Apply

The application for the Local Fiscal Year 2027 CRRC Grant will launch on Wednesday, January 14 at 12:00 p.m.

The application will be available through the Neighborly Portal. Registration for a free Neighborly account will be required.

Application trainings will be held on the following dates:

- Friday, January 16 at 2:00 p.m. on Zoom

- Thursday, January 22 at 5:30 p.m. at the Heritage Complex in Annapolis

- Monday, January 26 at 5:30 p.m. at the Brooklyn Park Library

- Wednesday, January 28 at 5:30 p.m. at the Severn Center

- Thursday, January 29 at 1:30 p.m. at the Busch Annapolis Library

Any questions or requests for additional information about the CRRC in general, funding opportunities, or meetings of the commission can be sent to Maggie Staudenmaier, Grants Associate, at mstaudenmaier@acdsinc.org.

Come Serve Your Local Government

Have you ever wanted to serve on a board or commission? Now is your chance! Several AACO Boards and Commissions currently have vacancies to be filled.